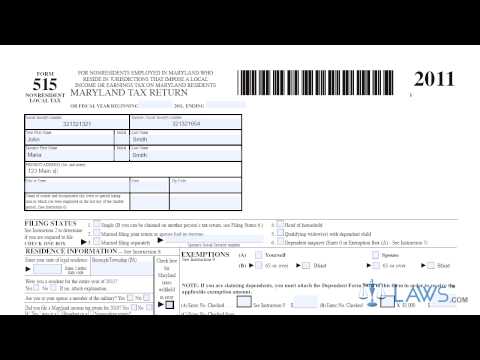

Law.com legal forms guide form 515 is used for filing the individual income tax return by non-residents employed in Maryland. This form is specifically for those who are employed in a jurisdiction that imposes a local earnings tax. The form can be found on the Comptroller of Maryland's website. Here are the steps to complete form 515: 1. Start by entering your social security number and name, along with your spouse's information if you are filing jointly. 2. Next, provide your present address, including the city, state, and zip code. 3. Enter the name of the county where you were employed on the last day of the taxable period, as well as the name of the incorporated city, town, or special taxing area. 4. Indicate your filing status by checking the appropriate . 5. In the "Residents Information" section, enter the two-letter abbreviation of your state of residence and the borough or Township. Answer all questions about your residency in Maryland with a check mark for yes or no. 6. Check the if state taxes were withheld in error. 7. Indicate all exemptions you are claiming in the applicable section. 8. Document your income and adjustments on lines one through 17. Report your federal income or loss in column one, your Maryland wages in column two, and your non-Maryland wages in column three. 9. Document additional income on lines 18 through 21. 10. Document subtractions to your income on lines 22 through 25. 11. Indicate whether you are using the standard or itemized deduction method on line 27. 12. Calculate your taxable net income according to the instructions on lines 28 through 32. 13. Compute your state taxes owed on lines 33 through 39 and your local taxes owed on lines 40 through 44. The total of both should be documented on lines 45 through 49. 14. Lastly, make the final adjustments on lines...

Award-winning PDF software

Mw508 2021-2025 Form: What You Should Know

An annual Employer Report (Annual Employee Return) on real property interests by nonresidents. If you work for a nonresident company, you must still file a Form W-2 from your business and report any income and loss from the Maryland property you own.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do USCIS Form I-508, steer clear of blunders along with furnish it in a timely manner:

How to complete any USCIS Form I-508 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your USCIS Form I-508 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your USCIS Form I-508 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Mw508 form 2021-2025